Understanding Financial Aid

APU on ScholarshipUniverse

All admitted students with an APU NetID can easily find and apply for APU and external scholarships—all in one place.

An APU Education Within Your Reach

When it comes to paying for college, students do not pay the full tuition cost, thanks to the support of financial aid such as scholarships, grants, and loans. In fact, at APU, 100% of new students receive some form of financial aid.

Several financial aid options are available to you as an APU student, including academic scholarships, nonacademic or participatory scholarships, grants, and loans. We invite you to explore the following resources to learn more about how an APU degree sets you up for success as you pursue your calling. You can also estimate your true college cost by using the net price calculator.

Estimate your true college cost by using the net price calculator

Consumer Information

Azusa Pacific University is required to disclose certain information to help students, parents, and employees make informed decisions.

View additional consumer resources.

Preparing Successful Graduates

On average, a college graduate earns $30,000 more a year than a high school graduate, according to the Bureau of Labor Statistics. And more students graduate within four or five years at Azusa Pacific as compared to students at public universities, lowering the overall cost of a degree and allowing them to begin careers sooner. Most importantly, employers actively seek APU graduates for their competence, character, and creativity. In fact, 75.8% of graduates reported securing employment upon graduation, according to APU’s 2018 destination survey.

Numerous on-campus job opportunities for students

70% of students participate in internships (many of which are paid)

Loan Repayment

Many students graduate college with some loan debt. With increased employability, statistics show that APU alumni find jobs and start paying back student loans sooner. This increased employability also leads to a significantly lower loan default rate for APU students as compared to graduates of other universities, according to the U.S. Department of Education.

$23,092 average loan debt of APU graduates

$40,750 average debt of students attending a nonprofit, private institution2

Next Steps

It’s never too early to begin the process and learn about your available financial aid opportunities. Our admissions representatives are ready to help you navigate the process.

- Visit campus to learn more about APU.

- Apply to Azusa Pacific!

- Apply early for financial aid. Complete your FAFSA. (APU’s FAFSA Code: 001117)

- Contact your admissions representatives with any questions.

- Watch for a financial aid offer to arrive! Accepted students who have completed the FAFSA will receive a financial aid offer to help as they make their college decision.

Contact Information

Email: [email protected]Phone: (626) 815-2020

Fax: (626) 815-3809

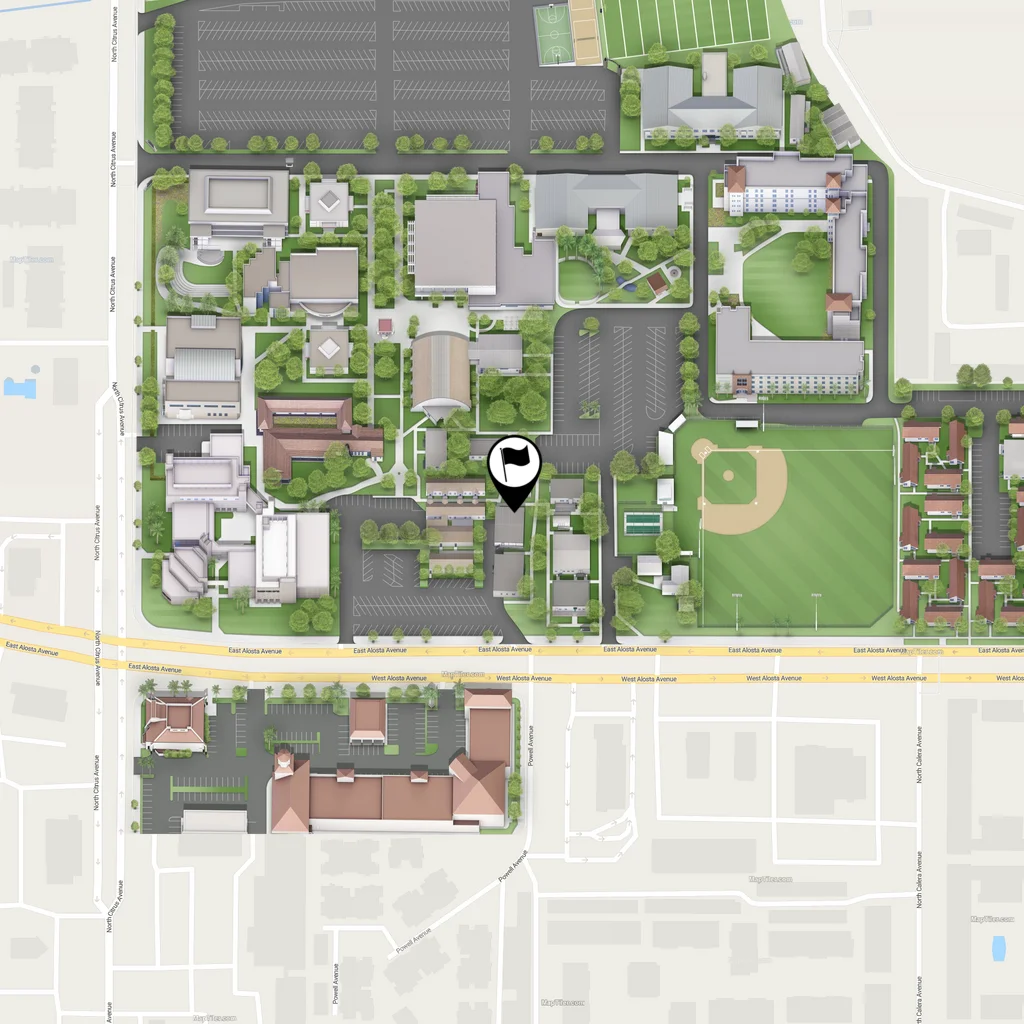

Location

Modular Offices, Building 29Footnotes

- Source: College Scorecard, Last Updated: January 22, 2023

- Source: Education Data Initiative, Last Updated: January 22, 2023